Unveiling 10 CPG Trends Shaping the Future of the Industry

2022 has been a rollercoaster ride for many CPG brands. Between inflation, supply chain problems, and ever-changing consumer behavior, a lot is going on.

As we look ahead to the new year, it’s clear that steering the growth of the CPG brand might be a bit challenging,

But fortunately, not everything on the horizon is looking bleak! As some opportunities are going away, plenty of opportunities are emerging to help your brand grow multifold in the coming years.

To make things easier, we’ve put together all the upcoming CPG trends in one place to help you create your business plan for 2023.

The areas we’ll address in this blog are:

- CPG market size and growth trend in 2023

- CPG industry trends in 2023

- How to navigate the evolving CPG market in 2023?

CPG market size and growth trends

Consumer packaged goods (CPG) are a vital part of everyday life for most consumers. From food and drinks to apparel and cosmetics, CPG products are used daily in households and need regular replenishment or replacement.

Therefore, the demand for these items is consistent, creating a competitive environment for all brands.

Despite this competition, the CPG market has been experiencing significant growth in recent years. In 2022, the CPG market was valued at US$ 2060 Bn in 2021, and it is projected to reach US$ 2808 Bn by 2030, growing by a CAGR of 3.5%.

Now, the growth of global CPG brands is broken into different segments.

- Categories

- Channels

- Geography

By Category:

The CPG industry is classified into six categories.

- Food and Beverage,

- Personal Care and Cosmetics,

- Household Supplies,

- Wholesale,

- Agricultural products,

- Others.

Food and Beverage (F&B) category products are expected to see the maximum growth in the coming years because of the low shelf life, increasing population, and changing customer habits.

By Distribution Channel:

CPG products enter the market via two channels. Offline and Online.

While traditional offline channels were the norm in the past, increasing digitization and a growing number of online users are driving brands to shift their focus online.

With that, the online distribution channels are expected to grow by a whopping 8.3% CAGR from 2020 to 2027.

The primary online channels include marketplaces like Amazon, and Walmart, DTC websites, and social media.

Additional guide: A Look at the Challenges DTC Brands is Confronting Today.

By Region:

In 2021, North America had the highest market share for CPG products. The valuation in this region was around $598.9 billion in 2021, with a market share of 35.2%.

However, in the coming years, Asia Pacific is predicted to grow in the CPG market with a 5.7% CAGR from 2020 to 2027. It’s primarily because of the exploding population in India and China.

Now that you learned about the CPG growth trends, let’s learn the state of the CPG industry in 2023 and how to navigate it.

The state of CPG industry trends in 2023

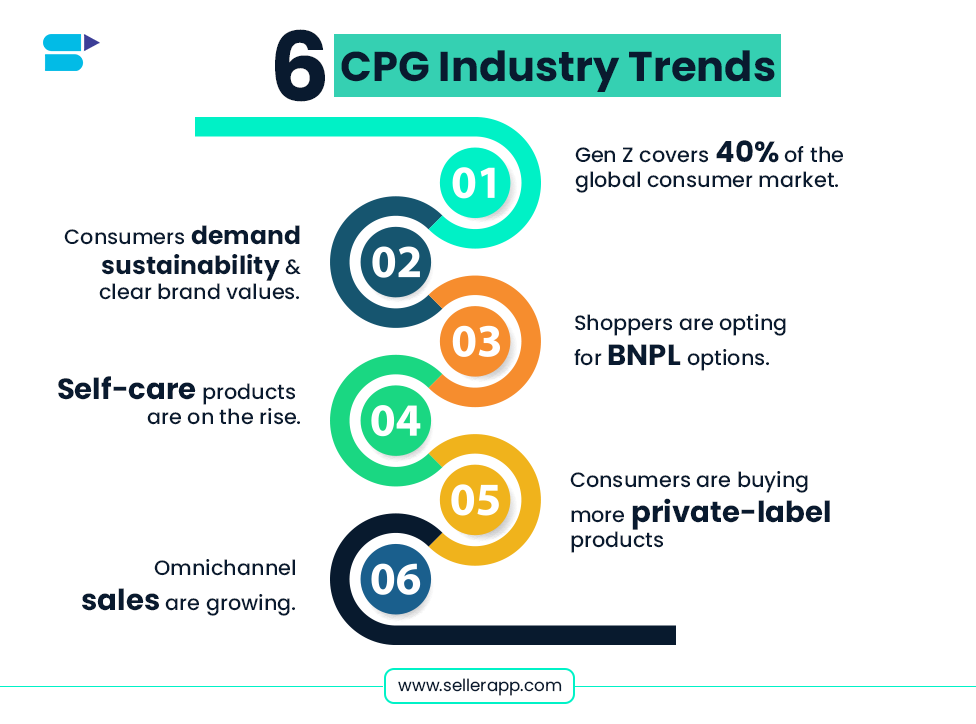

If you’re a CPG brand owner or follow the e-commerce space, you know the market is growing rapidly. Let’s learn some of the emerging trends in CPG marketing in 2023:

Gen Z is 40% of the entire global consumer market (source)

As the world shifts into a new era of digital commerce, it’s important for businesses to pay attention to the rising influence of Gen Z. With a massive spending power of $143 billion, this generation makes up 40% of the global consumer market (source).

And, unlike the older generations, Gen Z is heavily influenced by social media a whopping 97% of Gen Z shoppers use social media as their top source of purchasing inspiration.

So, what does this mean for retailers and CPG brands?

Gen Z is quickly becoming a major part of the consumer market, and it’s crucial for businesses to stay ahead of the curve and find ways to effectively reach this demographic, even if it means disrupting traditional marketing tactics.

Inflation has shot up the prices of CPG products.

Another looming worry for CPG brands and marketers is everything is getting expensive.

- The Q4 2022 number shows some promises, as inflation dropped from 8.2% to 7.7% in October. However, the CPG inflation still holds a record 12% compared to last year.

- It has created a domino effect on every price. From manufacturing and shipping costs, everything shot up dramatically. And it has led to a more than 3.2% rise in the consumer prices of CPG products. However, the changing lifestyle is only leading to a residual demand, further reducing the profit margin for CPG brands.

How consumer behavior is shifting with inflation

The past few years have seen a significant shift in consumer spending habits. People have had to adapt to a tumultuous economic situation marked by inflation, the pandemic, and supply chain issues.

While essential CPG products like food and household goods remain in high demand, many consumers have found ways to cut back on consumption.

44% of shoppers are moving from ordering online to cooking food at home, and 40% are trying to minimize waste.

A further 31% of shoppers said they only buy if the product is on offer, and 26% stopped buying unnecessary products altogether.

But will these continue into 2023, or is something new on the horizon?

Let’s see what the top consumer trends in 2023 are.

Consumers demand sustainability and clear brand values.

Green consumerism has been rising for some time, but the COVID-19 pandemic kicked it into high gear. Many consumers, mainly Gen Z, now avoid brands that don’t align with their stance on the environment and other sustainability issues.

Almost half of the internet users (53%) say they would use a brand or store less frequently if they discovered that a brand or store wasn’t operating sustainably (source).

Furthermore, 70% of consumers say they are willing to pay at least 5% more for products demonstrating a fully sustainable supply chain.

Following the trend, CPG brands themselves became sustainability-focused across the world. In the last two years, F&B sales increased by 25% for products that focus on environmental sustainability, social responsibility, and animal welfare.

Consumers are more focused on convenience.

In 2023, the purchasing decision will revolve around how fast the product is delivered.

In fact, studies have found that

- 62% of shoppers say delivery speeds influence their purchasing decisions (source).

- 30% of consumers expect same-day delivery.

- 85% of online shoppers search elsewhere when delivery time is too long.

It’s not just about speed. 48% of consumers say they will pay more for an item if it comes with faster shipping.

This trend is a significant opportunity for CPG brands to uplevel their logistics game and support same-day delivery to attract and retain more customers.

Customers are looking at BNPL options.

As online shopping continues to grow, consumers demand a wider range of payment options from brands. This includes offering various ways to pay, such as accepting Cash on Delivery (COD), credit and debit cards, PayPal, and Buy Now, Pay Later (BNPL) services.

Speaking of BNPL services, they are particularly popular with Gen Z shoppers.

Over 44% of Gen Z digital buyers say they’ve used a BNPL service at least once by 2022 (source). And according to MarketWatch, overall revenue from BNPL was up a staggering 72% year-over-year in the Q3 of 2022.

As we head into 2023, it’s clear that BNPL is a trend that is here to stay.

Recommended read: What are the reasons for losing the Amazon Vendor Buy Box?

Consumers are buying more private-label products.

As consumers continue to search for the best deals on a budget, private-label products become a popular choice.

This trend can be attributed partly to the availability issues during the 2020 pandemic, which led many shoppers to try out private-label products for the first time.

But, once they found a product they liked, a whopping 80% of customers indicated they intended to continue using it.

Inflation has also played a role in the shift towards private labels, as 65% of shoppers say they are willing to switch brands if prices are too high (source).

This trend also poses a threat to CPG brands, as private-label products are often more profitable than other products.

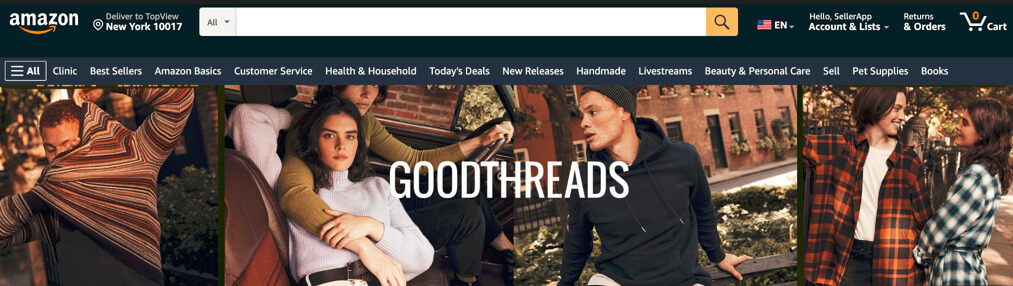

One example of this is Amazon’s private-label clothing brand, Goodthreads, which is competing with big brands like H&M, Levies, and Uniqlo.

As consumers continue to look for ways to stretch their budget and get the most for their money, CPG brands need to keep an eye on the rise of private-label products and consider how they bring innovation into products and marketing strategies to get back the market share.

Omnichannel sales are growing.

Omnichannel sales are on the rise, and it’s no surprise when you consider the fact that 40% of online shoppers are Gen Z.

But, it’s not just about reaching customers on multiple channels – it’s also about offering a seamless, integrated experience across all channels.

SellerApp studies show that brands that offer robust omnichannel experiences can see a 19% boost in total revenue.

In fact, brands that use at least three channels in their retail strategies see a 287% higher purchase rate compared to single-channel brands (source).

It’s no wonder some of the most successful companies, such as Dove, L’Oreal, Colgate, Coca-Cola, and Pepsi, use Omnichannel strategies to reach customers wherever they are.

L’Oreal, for example, allows shoppers to virtually try on their products on their D2C website, while Pepsico has launched two D2C websites that sell food and drink bundles.

With the modern consumer journey being non-linear, it’s important for CPG brands to nurture buyers on their favorite platforms conveniently.

Self-care products are booming

As sustainability and personal growth become increasingly important to millennials and Gen Z, it’s no surprise that these categories of products are set to gain more traction in 2023.

One area that’s expected to see significant growth is the self-care market. The revenue from the e-commerce personal care market in the United States stood at $53.7 billion in 2021, estimated to reach $79.3 billion by 2025.

Plant-based products are on the rise

Another trend to watch out for is the rise of plant-based products. According to Datassential’s 2023 Food Trends, 40% of consumers plan to purchase plant-based meat products in 2023. And by 2024, the industry is forecasted to reach a massive $480 billion market.

CPG brands are spending big on marketing.

The CPG industry is known for its fast-paced and competitive nature. So it’s no surprise that CPG brands are willing to invest heavily in marketing and advertising efforts.

But how much do CPG brands spend on advertising?

According to recent data, CPG brands are estimated to spend $38.83 billion on advertising each year (source). And, with 64% of CPG brands planning to increase their retail media spending in 2023, it’s clear that this industry is committed to staying ahead of the curve and reaching customers wherever they are.

One example of this increased investment can be seen in the skincare industry, where big players, including Johnson & Johnson, L’Oreal, and Unilever, who accounted for 19% of total spending, increased their investment by 8% YoY.

L’Oreal, in particular, saw a significant increase in spending – a 32% month-over-month increase in November 2022 (source).

How to navigate the CPG market in 2023

Considering different trends in the CPG industry, here are some of the ways to navigate the CPG market in the coming years.

Explore co-marketing opportunities

Co-marketing is a strategic partnership between two or more brands in which each brand promotes the products or services of the other brand.

Co-marketing usually allows brands to

- Access new audience: By partnering with another brand, CPG brands can tap into the partner’s customer base and reach a new audience. This can be especially beneficial for brands that are looking to expand into new markets or demographic segments.

- Increased brand credibility: When two brands partner together, it can increase the credibility of both brands in the eyes of consumers. This can be especially useful for small-mid CPG brands that are trying to establish themselves in a crowded market.

- Cost-effective marketing: Co-marketing campaigns can be more cost-effective than traditional marketing efforts because they allow brands to share the costs of marketing. This can be especially beneficial for smaller CPG brands with limited marketing budgets.

- Increased customer loyalty: By providing customers with a wide range of products and services, CPG brands can increase customer loyalty and encourage repeat purchases. Co-marketing partnerships can help brands to expand their product offerings and keep customers coming back for more.

One example of a successful co-marketing partnership in the CPG industry is the collaboration between Kellogg’s and candy company Just Born.

Together, they brought Peeps cereal to market, allowing consumers to enjoy Peeps marshmallow bunnies and chicks at the breakfast table in addition to their traditional Easter basket inclusion. This partnership has proven successful, with the cereal returning to shelves for the past three years.

Invest in Social Commerce

Social commerce is a growing trend in the CPG industry, with a projected $30.73 billion in sales in 2023, accounting for 20% of global retail e-commerce sales (source).

Consumers, especially Gen Z, use social media platforms like TikTok for search and product recommendations. In fact, 48% of consumers are now likely to purchase directly from TikTok.

So, it’s evident that brands that want to succeed in the coming year should include social media in their e-commerce strategy.

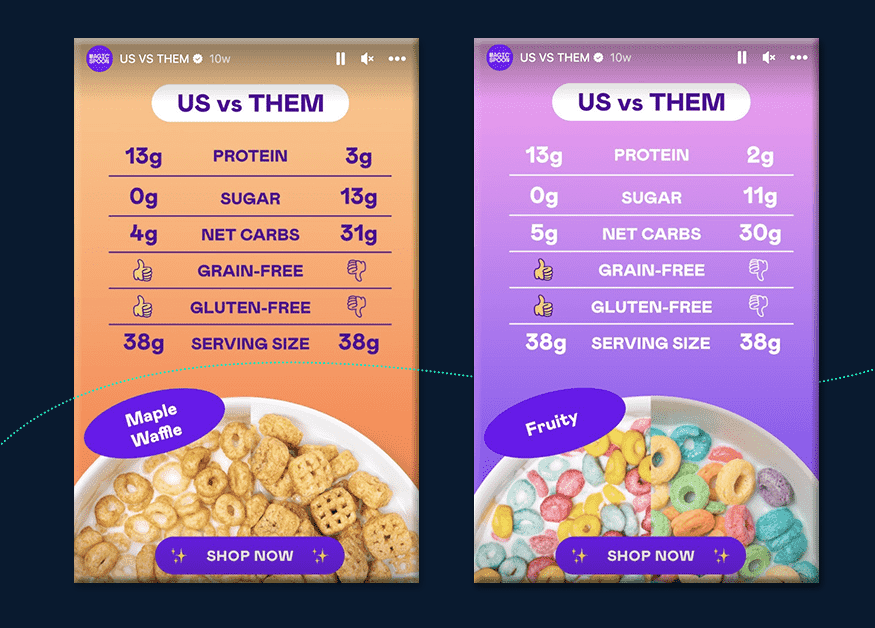

One brand that successfully integrated social media is Magic Spoon, a cereal brand.

They use Instagram to tell their brand story and compare how they are better than their competitors. For example, they have an Instagram Stories highlight titled “Us vs. Them,” where they compare their cereal’s protein and carb makeup versus popular competitors.

Using social media to connect with consumers and showcase their products, CPG brands can drive sales and build a loyal customer base. As social commerce continues to grow in popularity, brands need to have a strong presence on these platforms.

Provide a personalized experience

Providing a personalized experience is key for CPG brands looking to stand out in the crowded market. In fact, 60% of consumers say they will become repeat customers after a personalized shopping experience (source).

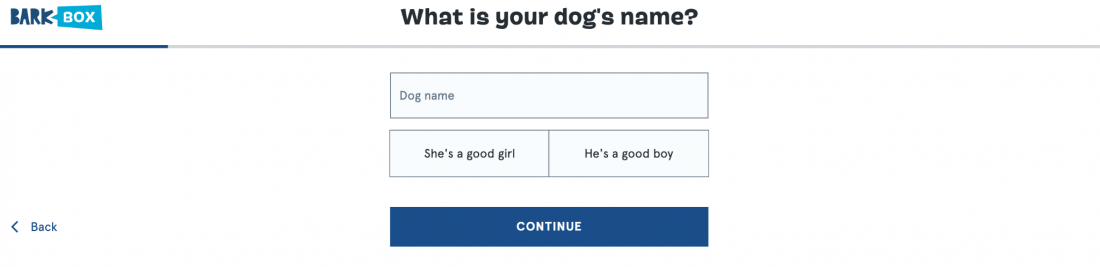

Data is crucial in creating a personalized shopping experience, allowing brands to target their consumers directly. Many CPG brands use product quizzes and surveys to personalize the shopping experience.

For example, BarkBox, uses questions like What’s your dog’s name? How big is it? How old is it? To gather information about their customer’s requirements and give customized suggestions.

Not only online brands but even large retailers like Target and Walmart also focus on providing personalized experiences by merging online and in-store offerings and adding hands-on experiences such as AI tryouts to engage customers.

Focus on the mobile shopping experience

With mobile phones in their reach, shoppers spend a record amount of time online.

So, making the mobile shopping experience seamless is no longer optional – it’s essential.

Recent statistics show that mobile devices account for 71% of retail traffic and generate 61% of online shopping orders (source).

Furthermore, by 2024, global retail mobile-commerce sales are expected to reach $4.5 trillion and makeup 70% of total retail e-commerce sales.

For CPG brands, this means they must adapt to this mobile-first mentality to stay in the game. This includes designing mobile-first experiences and offering phone-friendly payment options, such as Apple Pay and Google Pay, to make mobile checkout as easy as possible.

Go local for global sustainability.

As consumers become more aware of the environmental impact of their purchases, they are demanding that CPG brands take a more active role in sustainability.

A recent study found that 76% of consumers believe it is important for CPG brands to reduce their carbon footprint, and 77% believe these brands should source their products responsibly (source).

In response to this demand, CPG brands can look towards local product sourcing and manufacturing. This way, brands can reduce their carbon footprint and have more control over the supply chain. This approach also offers cost benefits and the potential for more sustainable fulfillment practices.

Take the example of this membership-based online platform Thrive Market, selling organic groceries to consumers. They’ve gained popularity for their eco-friendly shopping experience that extends from product sourcing to the fulfillment process.

As more consumers seek out sustainable options, we will likely see more CPG brands following suit and prioritizing sustainability in their business practices.

Push subscription-based products: to drive retention

As the competition in the CPG industry continues to grow, brands should look for ways to drive retention and keep customers loyal to their products. One strategy that is gaining traction in this is the use of subscription-based models.

Subscription-based models allow customers to receive regular shipments of products they frequently use, such as toothpaste, cleaning products, and groceries. This not only ensures that customers always have essential items, but it also helps CPG brands to retain existing customers.

According to recent data, almost 35% of weekly online shoppers are already using subscriptions, and trends in D2C suggest that this number will continue to grow in the coming years.

In fact, by 2023, subscription models are expected to become even more important for CPG brands looking to drive retention.

One way to promote the subscription model is by embracing more miniature portion packs for CPG products. It can reduce customer friction associated with high costs and increase retention and profit margins. Additionally, it’s more environmentally friendly as fewer raw materials are used.

Try limited-release drops to get more conversion.

Recent trends have shown that the number of brands releasing limited-edition items has risen by 12% since 2022. Additionally, 40% of these brands are intentionally launching limited-edition products to increase conversions.

Limited-release drops to get more conversions for two reasons:

- It evokes urgency: Potential customers feel they must buy now or the product will be sold out and unavailable.

- It helps CPG brands resolve their supply chain issues: By releasing a limited number of products, they can better manage their inventory and ensure they don’t run out of stock. This way, customers are already aware that they may not get a chance to buy in the future, and it won’t result in a negative customer experience.

One CPG brand that has successfully implemented this strategy is Supreme, a skateboarding lifestyle brand. They use weekly product drops by collaborating with major brands like Nike, Levi’s, and Lacoste to increase their conversion and gain popularity.

Recommended read: What is Amazon FBA small and light?

Go offline to build brand awareness.

In the past couple of years, brick-and-mortar has struggled due to the pandemic as consumers turned to online shopping as an alternative.

However, with lockdowns lifting and consumers now able to try products in-store, experiential retail is making a comeback in 2023. According to a recent survey, 32% of consumers said they would like to return to try out products in-store.

The best part is experiential retail doesn’t have to be a huge investment in opening a new brick-and-mortar store.

It can be interactive advertising campaigns on billboards and prints targeted toward customers in a specific location.

One example is the CPG brand Wild Dose, which has created tearable advertisements placed in hotspots that their customers frequent as an effective way of building brand awareness.

Get expert influencers onboard into your brand

As competition in the CPG industry intensifies, it has become increasingly important for brands to find ways to stand out and capture shoppers’ attention.

By partnering with the right influencers, brands can stay at the forefront of shoppers’ minds, promote product discovery, and increase sales.

However, with the rise of platforms like TikTok and Instagram, the term “influencer” has lost its charms.

It also becomes increasingly difficult for consumers to differentiate between genuine recommendations and those who have been paid to promote a product. Thus, making it harder for brands to build trust and credibility.

Brands can eliminate this by partnering with expert influencers who are qualified in the field.

For example, brands like Everydaychews partner with veterinarian influencers to promote their products and build customer trust and credibility.

Final Thoughts

In today’s competitive CPG industry, a strong brand is essential for companies to succeed. Whether you’re launching new products or are an established company, a well-defined brand identity can help you connect with customers and build a loyal following.

There are various techniques you can use to grow your brand. This includes market and competitor research, listing optimization, PPC ads, etc. Additionally, you can use DSP and OTT ads to engage your customers on multiple platforms.

At SellerApp, we help brands like yours create effective advertising strategies to increase brand awareness, reduce ACoS, and facilitate uninterrupted growth for your business.

We’ve already helped 20,000+ sellers increase their revenue by 600% and reduce ACoS by 50%. And we can do the same for you too!

What trends do you see coming in the next years? Share your thoughts in the comments – and don’t forget to share this with others.

Happy Selling!

Recommended read:

Which one should you choose – EDI or API?

Master Inbound and Outbound Logistics to Gain a Competitive Edge.

What are Fast-Moving Consumer Goods (FMCG)?

Stella Sharon

January 13, 2023I recently read the CPG trends article from SellerApp and was impressed with the level of detail and insights provided. The information was well-researched and presented in an easy-to-understand format. I especially appreciated the section on e-commerce and how it’s impacting the CPG industry. Overall, a great resource for anyone in the business.”

Joel

January 13, 2023I found the CPG trends article by SellerApp to be very informative and helpful. The data and statistics included were relevant and up-to-date, and the analysis provided valuable insights into the current state of the CPG industry.

Soumya

January 13, 2023The tips and strategies suggested for navigating the changing landscape were practical and actionable. i highly recommend this article to anyone in the CPG field.