Amazon Seller Tariff Costs in 2025: How to Protect Your Margins and Stay Competitive

If you’re an Amazon seller, there’s no way we can sugarcoat the new tariffs in 2025. In the world of ecommerce, tariffs are like those hidden costs that sneak up on you and bite hard. They directly affect how much you pay for products, and ultimately, eat into your profit.

As much as tariffs have been a part of the international trade conversation for years, the new tariffs in 2025 are creating a whole new wave of complexity, having you rethink about set practices.

So, if you’re still breathing easily, thinking it won’t affect your business, think again. Let’s dive into the details of Amazon seller tariff costs, why these tariffs are coming into play, and how you can sail through them like a pro.

What Are the New Tariffs in 2025?

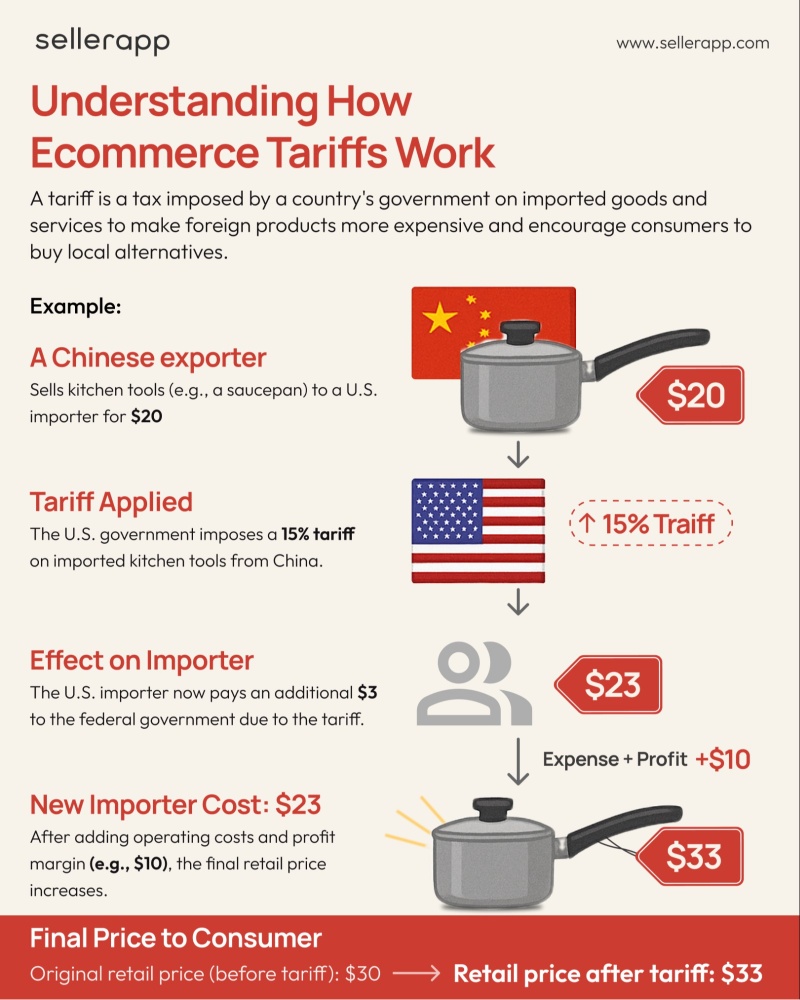

To set the stage first, let us explain what these new tariffs actually mean. Tariffs are essentially taxes imposed on resellable items that are imported from other countries.

This means that if you’re sourcing products from overseas, like most Amazon sellers, the cost of importing those products into the U.S. is going to soar significantly, creating a massive impact on your pricing strategy and overall supply chain pipeline.

In some cases, given the massive spike in tariff percentage, many are pivoting to other countries for sourcing or contacting manufacturing units from within the United States.

Why is Trump using tariffs?

Under the new tariffs in 2025, President Donald Trump has reinvigorated his trade policies. This has led ecommerce sellers to pay:

- A blanket 10% tariff on all goods imported into the U.S.

- Targeted tariffs up to 145% on goods imported from China (variable dependent upon item category and order value)

This is no minor change.

If you import anything from China, the biggest wholesale market in the world, the tariff charge levied upon you can go up to 11-145%. According to the New Tariffs in 2025 on Chinese products, items of over $800 shot up from 104% to 125%.

For instance, imagine you’re sourcing hair accessories from China at $3.00 per unit. With a 30% tariff applied, your new tariff in 2025, net cost would jump to almost $4 per unit. That’s before you even include your shipping charges. With added Amazon FBA fees and any other costs piling on top of the cost price, by the time it reaches the customer, it touches almost $9.

This is where things get tricky— Amazon often tries to sell in high volumes, keeping the profit margin thin and aiming for the Buy Box acquisition. The new tariffs in 2025 cost you a significantly higher amount compared to the previous.

Something that you didn’t account for before the announcement. Now, when it has been abruptly imposed, you hardly have the breathing room to reconsider and restructure your existing strategies.

Most importantly, what was profitable then isn’t now, potentially leaving you scrambling to find ways to absorb those extra costs without sacrificing profit. So, either as a seller, you are fighting to earn a fair margin or losing out on the Buy Box possibilities.

Why is Trump using tariffs?

Especially when your business strategies are all set and running, what might be the reasoning behind these new tariffs in 2025?

The primary goals of these new tariffs are to:

- Pressure foreign distributors, particularly China, to negotiate deals that are more profitable to the U.S government.

- Encourage demands for in-house distribution and the rise of these U.S.-based manufacturing units simply by making imported goods more expensive.

- Reduce the U.S. trade deficit by decreasing the flow of foreign goods into the country.

Note: The U.S. trade deficit is the amount by which the value of what the United States imports is greater than the value of what it exports.

However, while these policies may serve the intended political purposes of the US government, they also leave sellers like you feeling the pinch, particularly when it comes to Amazon seller tariff costs. If you’re not adjusting to these changes fast enough, you may be pushed to bite the bullet.

Ultimately, the bottom line is that these tariffs are designed to make foreign goods more expensive, which could shift the landscape for many Amazon sellers, particularly those heavily reliant on Chinese imports. It’s not just about a few extra bucks per unit, it’s about the snowball effect it may have, eventually leading you to bleed money.

How Will These New Tariffs in 2025 Affect Amazon Sellers?

In early May, rumors swirled that Amazon planned to display import tariffs as a separate line item on ultra-low-cost products sold via its Haul storefront. Haul is a Temu-style marketplace that sells products under $20. But it was quickly denied by Amazon. It was later clarified that the head of Haul considered the idea of listing import charges on certain products, but however far from being implemented. The step was never approved.

- You won’t see a clear breakdown of the Amazon seller tariff costs, and thus, you’re less likely to know how new tariffs in 2025 are affecting your fees.

- Amazon won’t notify you directly about changes in your costs. It’s on you to track how your Amazon seller tariff costs are evolving to stay profitable.

- You’ll need to be proactive to figure out the cost increases, rather than waiting for Amazon to inform you.

While this lack of transparency around Amazon seller tariff costs might feel frustrating, it also prevents opportunities that may come your way. Sellers who fail to keep tabs on these shifts could be caught off guard, while savvy sellers can use the data they gather to stay ahead of the curve.

If we break it down into simple actionables, you’ll have to:

- Monitor your product costs closely, especially if you’re importing from China.

- Keep an eye on changes in your Amazon FBA fees and shipping costs.

- Tracking the changes in your profit margins to understand how much of your budget is being eaten up by tariffs.

- Your pricing strategy needs a complete refresh. So, bundle strategically to increase perceived value, add product differentiation through Amazon A+ content, packaging, and inserts.

Your buyers don’t care about tariffs. They care about price and value. Make sure your listing justifies any increase in cost, or risk losing conversion.

- The old model of paying 30% upfront and 70% before shipping may no longer work if your duties increase by thousands per container.

Renegotiate payment terms or shift to Delivered Duty Paid (DDP) to avoid surprise charges. Also, forecast your Q3/Q4 spend with buffer scenarios for multiple tariff tiers.

Yes, the new tariffs in 2025 are disruptive. They’re forcing sellers to re-engineer supply chains, rethink pricing, and take a much more hands-on role in cost management. But if you can master your numbers, adapt quickly, and optimize for this new normal, you won’t just survive 2025, you’ll grow faster than ever.

How the Smartest Amazon Sellers Are Thriving Despite the New Tariffs in 2025

The new tariffs in 2025 have rattled even the most seasoned Amazon sellers. While some sellers are panicking, the smartest ones are evolving. They’re not just reacting to the changes, they’re redesigning their businesses to resist the storm.

Here’s exactly what they’re doing and what you can start doing today to protect your margins and grow stronger in the face of rising Amazon seller tariff costs.

1. They’re auditing HS codes like their margins depend on it

Your product may be misclassified, and that tiny mistake could be costing you thousands every quarter.

Every imported product carries a Harmonized System (HS) code, which determines your customs duty rate. But here’s the kicker. A single product can often fall under multiple codes depending on how it’s described. One small wording shift can cut your tariff burden by 20%–40%, so be extremely cautious about how you describe your product.

One Amazon seller importing leather tool pouches was paying 25% in duties. After working with a licensed customs broker (like All Cleared Customs Brokerage or BorderBuddy) to reclassify them as “occupational safety equipment,” their tariff rate dropped to just 5%. It acts like a game-changing shift that saved them over $9,000 per quarter.

2. They’re Rebuilding Product Lines with Strategic Sourcing

The golden era of “China-first” sourcing is over. With the new tariffs in 2025 hitting Chinese imports the hardest, sellers who fail to diversify will feel the squeeze.

The smartest sellers? They’re playing the long game. They’re building modular, multi-country supply chains that look like this:

- Source components from China

- Add accessories from Vietnam

- Assemble in Mexico

- Fulfill via U.S.-based 3PLs

Yes, it’s more complex for sure, but this complexity can help you thrive in this chaos, at least save you from spending more. Brands that solve for this not only dodge massive tariffs, but they also own their pricing power again.

Apparel and textile sellers are pivoting fast to India and Bangladesh, regions that offer both cost parity and tariff stability. That’s a smart move if you’re in a high-risk category.

3. They’re Launching “Tariff-Neutral” SKUs

Here’s a mindset shift that’s changing everything. Not every product you launch needs to be vulnerable to global politics. Savvy brands are intentionally designing new SKUs that bypass the Amazon seller tariff costs altogether. These products are sourced from countries with a flat 10% tariff or built using U.S. or regional supply chains to protect margin.

To give you an example, a fitness brand might keep its high-tariff SKUs (like resistance bands or cast-iron weights) in limited stock but go all in on yoga mats, foam rollers, or recovery tools made in Vietnam or Turkey.

This is how smart sellers hedge their bets by building product portfolios that are flexible, profitable, and far less exposed to tariff volatility. That’s how you diversify your sources.

4. They’re Using Tariff Education as a Marketing Weapon

Instead of hiding behind rising prices, top-tier Amazon brands are leaning in. They’re using transparency as a marketing asset. How? They use:

- Branded inserts that tell your supply chain story.

- A+ Content that highlights your shift to ethical or local production.

- Instagram Reels or email flows explaining how you’re reinvesting in better logistics or cleaner sourcing.

This is how you turn price hikes into purpose-driven storytelling, keeping transparency to a maximum and having customers empathize with you. In fact, messaging like “We source ethically from Hong Kong” will work to convey the message more than silence or vague price changes ever will. In this way, you communicate about the item’s source as well as justify your price hike. But here’s the catch. Most sellers miss out on it.

5. They’re Going Global with Purpose

This might be the most overlooked but powerful response to the new tariffs in 2025. Sell where the tariff tension doesn’t follow you. Amazon sellers are expanding into markets that are less tariff-intensive and hungry for niche U.S. products.

To give you a better understanding, electronics sellers are finding opportunities in Amazon UAE and Canada, where supply chain tensions are lower. Home goods and kitchen brands are entering Amazon UK and Germany, where sourcing from Eastern Europe offers more tariff-friendly options.

Going global isn’t a nice-to-have anymore. It’s a survival strategy and in many cases, a springboard for growth. If your domestic profits are under siege, look overseas to diversify your income streams and rebalance risk.

Final Thoughts

The new tariffs in 2025 aren’t just a policy update, they’re a full-blown wake-up call for Amazon sellers. They’re reshaping how we source, price, and even imagine what a “profitable” product looks like. And if you’ve been feeling overwhelmed by it all, you’re not alone.

But here’s the thing: you don’t need to have all the answers right now. What you do need is a plan—and a willingness to pivot, even if that means rebuilding parts of your business from the ground up. Because while these tariffs are painful, they’re also revealing who’s ready to lead.

The smartest sellers aren’t playing defense. They’re auditing HS codes like accountants, exploring new sourcing regions, launching product lines designed to weather geopolitical storms, and being upfront with their customers about the why behind pricing shifts. Some are even expanding globally to markets that feel less volatile.

It’s messy. It’s complex. But it’s not impossible.

This moment demands more from you as a seller, but it also opens the door to something better. If you can lean into the hard work now, take a closer look at your numbers, your strategy, and your story, you won’t just protect your margins.

You’ll build something more resilient. More future-ready. More yours.

If its too overwhelming to catch up with, you can get hold of Market Intelligence custom services from SellerApp, which helps you make smarter decisions backed by deeper insights and better strategies, especially in complex situations like this when your strategies must be morphed considering loopholes of new tariffs in 2025.

So no, you can’t ignore these new tariffs. But you can outsmart them and maybe even come out stronger on the other side.

Read more:

Amazon Seller Repay: Charges, Customer Service, and Refund

Facebook Ads Tips For Amazon Sellers