Prepare for Amazon Q4 in 2026 (Q4 Amazon tips for sellers to Maximize Sales & Profit)

Are you still thinking to prepare for Amazon Q4 the same way you did a year or two ago? If yes, then you’re preparing for something that no longer exists. Because the patterns have shifted drastically.

CPCs are inflated across almost every major category, margins are tighter even for established brands, and Amazon’s upgraded relevance scoring is far less forgiving.

AI-driven listing audits, suppressed or rejected deals, and new post-2024 buying behaviors have reshaped what “Q4 readiness” actually means.

Much of this change comes from Amazon’s own infrastructure upgrades. AWD has altered how brands manage inventory flow, search ad placements now reward stronger trust signals, and Amazon Events AI has started predicting deal performance before sellers even hit “submit.”

Now, that’s the real disconnect between what most sellers think Q4 is and what it truly is now. The old belief that traffic alone will save a weak listing or that discounting hard enough guarantees conversions is outdated.

Today’s Q4 Amazon is algorithm-driven, reliability-focused, and highly competitive. The sellers who understand this shift early are the ones who enter the season with a competitive advantage, while everyone else scrambles to keep up.

This article breaks down what’s trending on Amazon and Q4 Amazon tips to help sellers scale their business this season.

How to prepare for Amazon advertising in Q4

You can’t turn on your Q4 Amazon advertising only when the Q4 traffic spikes, and honestly, this is something the sellers learn the hard way because Amazon’s ad system does not reward latecomers. It’s something you prepare for long before the rush begins.

The brands that scale every year are the ones that understand how Amazon behaves under Q4 stress and set up their ad engines to thrive inside that environment.

1. Rethinking ROAS Through a Contribution-Margin Approach

As a seller, you must know about what ROAS (return on advertising spend) is, but do you understand why it becomes unreliable when you prepare for Amazon Q4? ROAS naturally decreases when CPCs rise and competition increases, even when your campaigns are performing well.

Instead of shrinking budgets every time ROAS falls, sellers benefit far more by shifting their focus to contribution margin, the actual profit left after Amazon fees, COGS, and ad spend. That’s the metric that tells you whether your Q4 ads are truly making you money, even when ROAS looks unstable.

This mindset removes the emotional reaction to rising CPCs and helps you scale when it really matters. When you prioritize contribution margin, you can keep momentum, maintain visibility, and avoid pulling back at the exact moment high-intent customers are shopping.

2. Using Q4 as a Data and Relevance Tool

When you prepare for Amazon Q4, you realize that it isn’t just a sales event. The sellers who benefit most treat this period strategically rather than as a short-term profit gain. Every click improves your relevance score.

Every click, view, and conversion strengthens what sellers commonly call “relevance,” which isn’t a single public metric but a bundle of behavioral signals that Amazon’s algorithm tracks: CTR, conversion rate, add-to-cart rate, repeat sessions, price stability, and how efficiently your ads translate into organic movement.

Q4 Amazon amplifies these inputs because shopper intent and traffic are at their peak, so even small improvements in click-through or conversion can permanently shift how Amazon interprets your product’s fit for a keyword.

That elevated relevance carries forward into January and beyond, allowing well-positioned listings to hold rank, pay less for ads, and scale faster long after the holiday chaos ends.

And there’s one more advantage that experienced brands quietly benefit from, and that is that Q4 Amazon offers New Product Development (NPD).

The surge in search behavior exposes unmet demand, variation gaps, top-performing bundles, and repeat-purchase preferences. Sellers use this Q4 intelligence to plan new variations, build bundles, create seasonal extensions, or expand their catalog for the next year.

3. Choosing the Right Strategy for Your Category

Choosing the right category matters more in Q4 Amazon than almost any other time of year. Sellers in Beauty, Pets, and Home benefit from adopting aggressive, break-even strategies, as these shoppers tend to make repeat purchases.

Customer acquisition in these spaces creates long-term value, making a tight margin in Q4 a profitable decision over the next 6–12 months as opposed to categories where Q4 demand is purely seasonal or where retention is almost nonexistent.

For example, replenishable categories like beauty, supplements, pet care, home essentials, and baby products repay that Q4 investment because shoppers come back again and again. But hyper-seasonal niches like holiday décor, novelty gifts, costumes, or one-time electronics accessories don’t offer the same upside.

You might achieve a sale in December, but you’re not building a customer base you can remarket to, nor are you generating long-term relevance that translates into year-round revenue. In those categories, running thin margins in Q4 is just a cost, not a future asset.

On the other hand, items like electronics and toys do not have the same repeat purchase potential and frequently have higher return rates. Sellers in these marketplaces benefit from a cautious approach that maintains margins, prioritizes hero products, and focuses on efficient traffic over volume.

Knowing your category’s reality helps you choose a strategy that protects your bottom line rather than eroding it.

4. Turning Q4 Traffic Into reduced Q1 Revenue

One of the most overlooked benefits of Q4 spending is its impact on the months that follow. Even when a customer doesn’t convert during peak season, the visit becomes part of your retargeting network.

That means the ads you run in January and February reach more active audiences at significantly lower costs, with higher conversion rates and better profitability.

5. Treating Customer Acquisition as a Long-Term Asset

If you are an emerging seller, the biggest benefit of shifting your Q4 strategy is simple, you stop thinking in 30-day profit periods and start thinking like an established brand.

The customers you acquire during Q4 don’t disappear. They return for refills, new variations, bundles, and seasonal cycles.

After working with thousands of sellers for over a decade, we have come to understand that when sellers frame Q4 as a customer acquisition experience rather than a profit period, they make smarter bidding decisions.

You can invest earlier in visibility and enter the new year with a larger base of engaged shoppers, rather than an exhausted ad budget.

You should therefore rethink your funnel specifically for Q4, as shoppers tend to behave differently during this season. They search differently, compare more, and discover products through random keywords that don’t even exist in other months.

If you rebuild your funnel with that in mind, bigger discovery at the top, stronger intent capture in the middle, and clean retargeting at the bottom, you stop wasting money and start owning more of the demand spike.

And honestly, this is also where Automatic Ads pulls more weight than most sellers give them credit for. When sellers prepare for amazon q4, Auto campaigns become a cash cow. They pick up all the weird, new, seasonal search terms people suddenly start typing in. These are terms you’d never think of and won’t find in any keyword tool.

Use those Auto insights to sharpen your manual campaigns, and suddenly you’re not just buying traffic, you’re collecting real-time demand signals that will keep paying off long after the holiday rush is over.

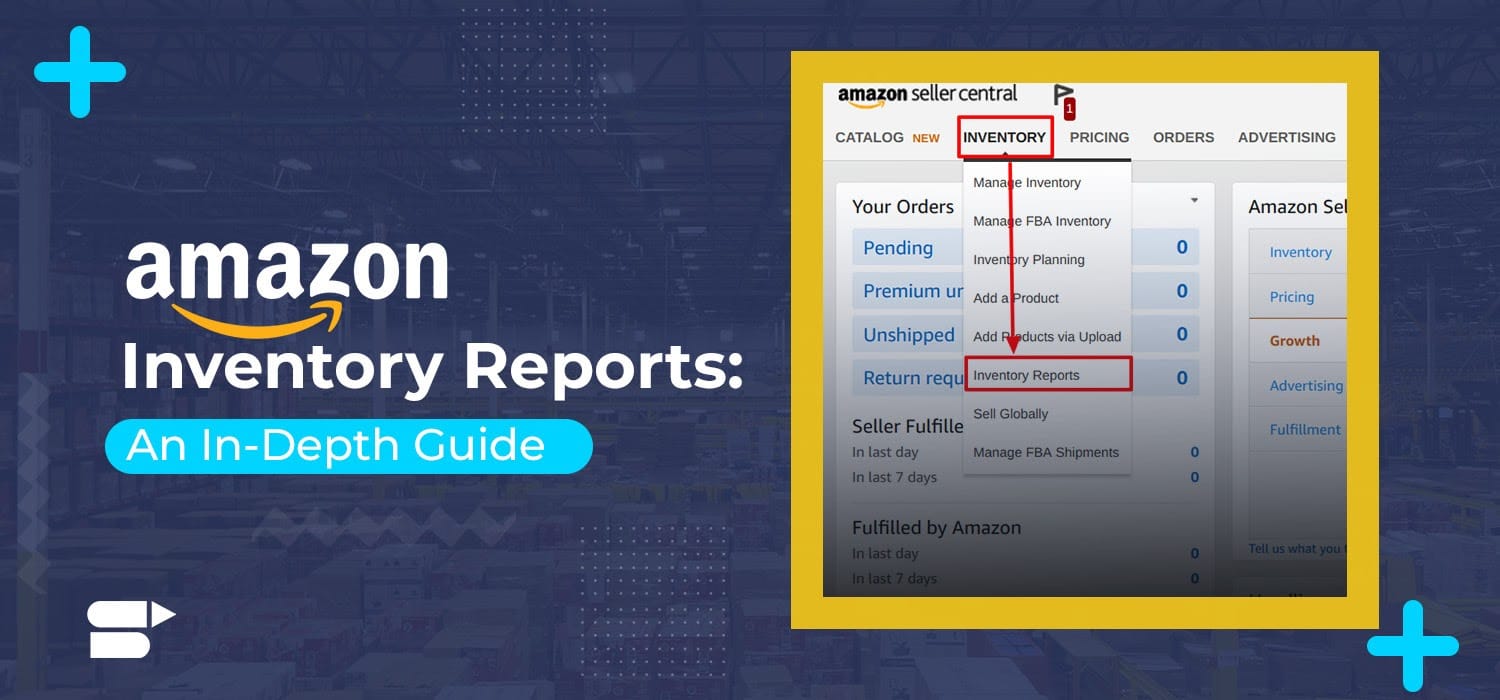

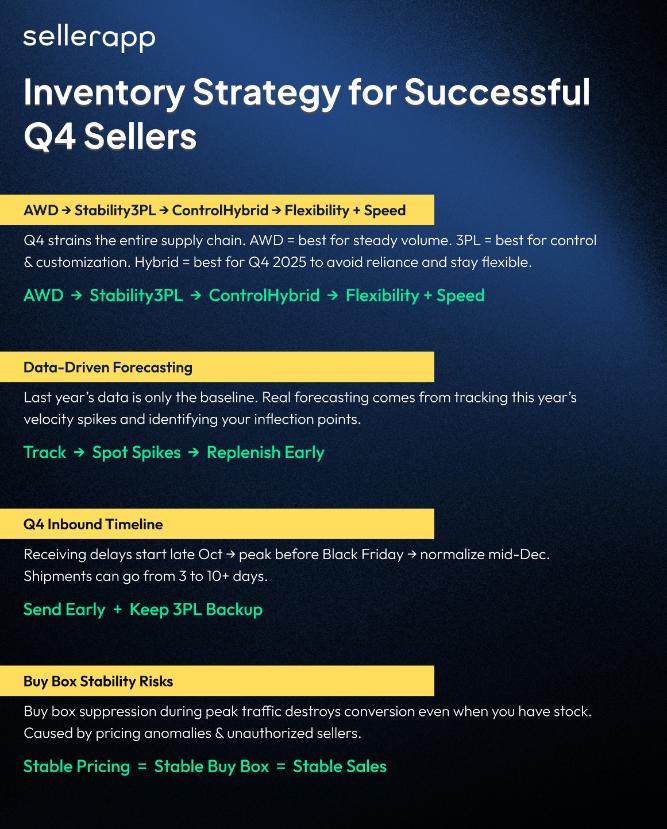

Inventory Strategy for Successful Sellers

Amazon’s receiving times slow down, fulfillment center transfers stall, restock limits tighten without warning, and one bad shipment can freeze your entire supply chain during the most important sales event of the year.

That’s why successful sellers don’t rely on a single fulfillment method or hope FBA will “just work.”

Here are four advanced inventory strategies for your brand to scale:

1. Choosing Between AWD, 3PL, and a Hybrid Model

Preparing for Q4 will put pressure on every part of your supply chain, and if you choose the right storage and fulfillment setup, half of the battle is already won.

If you are a seller who has continuous year-round volume and predictable supply cycles, then AWD is for you, as Amazon bears the majority of the work and ensures a steady inbound flow even when warehouses tighten their operations.

Then a 3PL approach is ideal for sellers that want more control over preparation speed, bundling, and margin, especially in categories with complex packaging or frequent product modifications.

However, for most brands, the hybrid model is the real deal as we approach Q4 2026. Honestly, this is what we recommend as well. FBA’s limitations can become obvious if your brand actually manages to make a killing during the first month itself. Now, with massive lead times and hoops to jump through, it’s best to use a hybrid method, as it doesn’t put too much pressure on your business.

Sellers observe abrupt spikes, cover delays, and immediately divert product when Amazon’s inbound network slows down while splitting inventory between AWD and a reputed 3PL. It avoids total reliance while still taking advantage of Amazon’s efficiency.

2. Forecasting Demand with Data

Go with the flow? You can’t with the inventory decisions for Q4. Sellers benefit most when they treat last year’s performance as a starting point, then build on the current year’s velocity spikes to create a realistic forecast.

The patterns are often similar. Demand builds slowly in late October, increases through November, and then swings sharply during event weeks, but the intensity varies.

The primary challenge is identifying your inflection points. Especially the moments when your daily unit sales suddenly jump. Tracking these patterns allows you to plan replenishments ahead of the surge rather than during it.

3. Understanding the Q4 Inbound Timeline

As mentioned earlier, Q4 logistics are significantly different than the rest of the year. It’s important to understand that there’s a predictable point when Amazon’s receiving centers begin to lag around late October to early November, and these delays intensify through mid-December.

This happens like clockwork, and shipments that took three days in September suddenly take eight or ten.

The slowdown typically hits in early November, peaks right before Black Friday, and doesn’t return to normal until mid-December. Sellers who plan to stock too close to the event’s week’s end up with inventory trapped in transit while competitors take the buy box.

The solution is simple but can be critical. You can essentially send core inventory earlier than you think you need to and keep reserve units with your 3PL (FBM) so you can react when delays inevitably appear.

After all, in Q4, timing becomes as important as quantity.

4. The risk of Buy Box Suppression During Peak Traffic

Most sellers are afraid about stockouts, and for good reason, but suppressed buy boxes can be even more destructive. When Amazon finds pricing anomalies or seller rivalry that undercuts your offer, it removes the buy box at the worst possible time. Traffic increases, but conversion rates drop.

Even if you resolve the issue promptly, the algorithm may flag your listing as unstable, impeding your recovery.

This is why inventory planning is more than just having enough inventory; it’s also about controlling your channel. Pricing consistency, preventing unauthorized sellers, and maintaining your listing stability can help you secure your Q4 more successfully than any overstocked warehouse could.

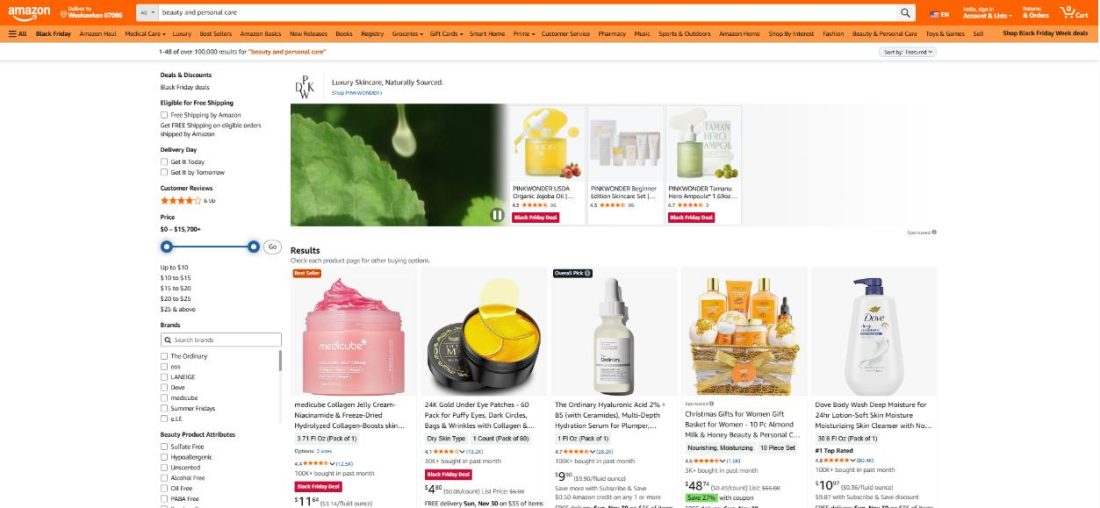

The Category-Specific Q4 Demand Map

One of the biggest mistakes sellers make in Q4 is assuming that all categories behave the same. They don’t, and that misunderstanding can kill margin, ranking, and deal performance every single year.

A strong Q4 strategy requires more than boosting bids or adding seasonal images. It requires understanding how demand actually forms in your category and then building inventory, deals, keywords, and ad pressure around those demand curves.

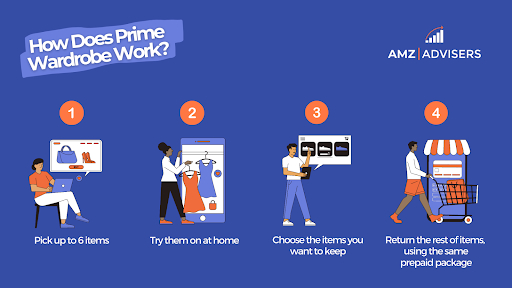

1. Beauty & Personal Care

Beauty is a mixed category, with elements of necessity, luxury, and a strong emphasis on gifts. When Q4 arrives, customers intuitively flock toward bundles because they reduce choice fatigue and feel more “gift-worthy” than individual SKUs. During peak weeks, bundled sets routinely outperform single units by 1.6-2.3x.

The actual opportunity for sellers is to use bundles to optimize margins. You can increase your average order value by pairing a high-margin item with a fast-moving hero SKU. Bundles can assist you in avoiding price wars by making comparisons more difficult for both customers and competitors.

2. Home & Kitchen

Home and Kitchen is one of the earliest categories to surge, as people begin preparing for gatherings before considering gifts. This early sale typically begins in late October, providing sellers with a quieter, less competitive window compared to the Black Friday chaos.

You need to realize that if you wait for November to scale, then probably it is going to be too late. Home & Kitchen sellers should use October to push relevancy, gather engagement signals, and lock in organic placement before CPCs jump.

Early optimization creates a spin effect, your ads become cheaper in November because Amazon already sees your listing as a stable category fit.

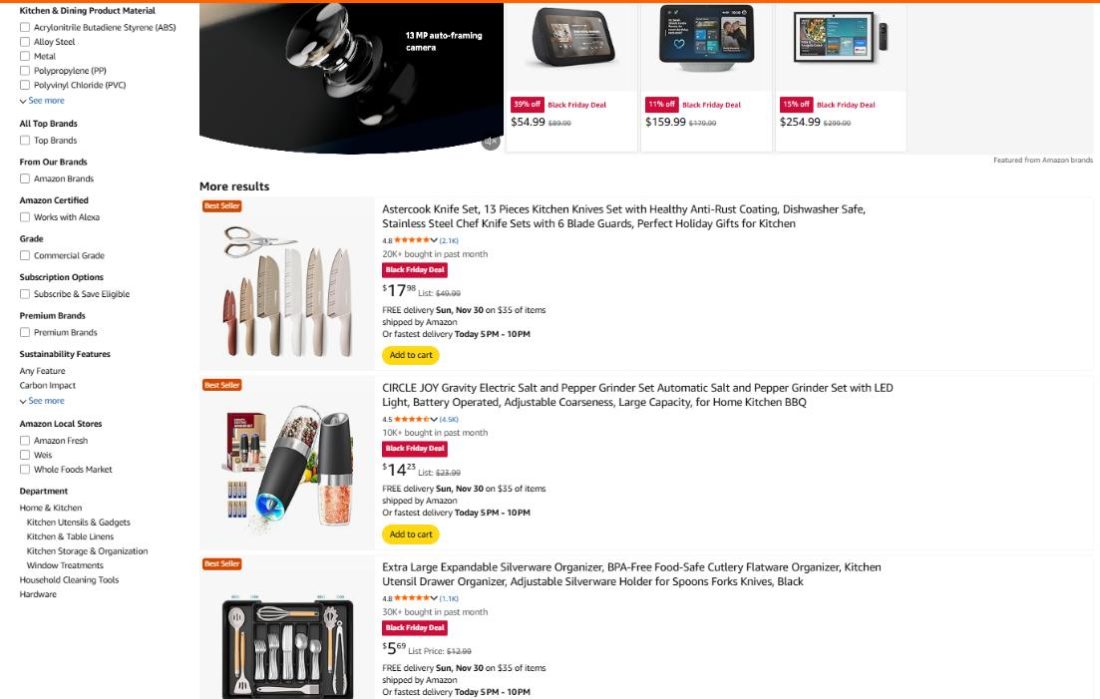

3. Electronics

Electronics have massive Q4 traffic, but there is one trap that we have mentioned earlier, and that is the return. Return rates spike sharply in January due to gift mismatches, feature confusion, and unrealistic expectations. A listing that looks highly profitable during December can turn negative by mid-January once returns are processed.

So to escape this rewrite PDPs to reduce uncertainty, use comparison charts to eliminate misalignment, and introduce clear “What’s in the box” visuals to minimize expectation gaps.

Sellers also prioritize product variations or bundles with inherently lower return likelihood (e.g., accessories). By understanding that electronics profit is measured over 60 days, not during the week of purchase, smart sellers protect their Q4 gains instead of watching January wipe them out.

4. Toys & Games

In Q4, this category was just as erratic as toys and games. Every week, trends change due to viral videos, classroom gossip, influencers, and social media. A surge that occurs one week may completely disappear the next. Relying only on FBA becomes risky as inbound delays start to occur because velocity changes so quickly.

An FBM failover strategy, which denotes a backup fulfillment system that takes over when FBA fails, is always maintained by the sellers who routinely win in this area. FBM keeps listing downtime during the busiest weeks and enables you to continue selling even when Amazon’s receiving centers slow down.

Additionally, you can swiftly test micro-trend SKUs without committing to large FBA inventories In the toy industry, agility is more valuable than forecasting accuracy, and FBM provides the flexibility your competitors lack.

5. Apparel

Apparel conversion increases dramatically during Q4 because gifting and seasonal buying overlap. However, apparel also has one of the highest return rates. Also, Returns often erase more profit than ads ever could. Sellers who fail to address sizing clarity often find themselves in a cycle of high sales followed by margin collapse.

The benefit for sellers is that this category rewards PDP clarity more than CPC spend. Detailed size charts, model guidelines, realistic product imagery, and clear fabric descriptions significantly reduce the return probability.

The more expectation-setting you do upfront, the cleaner your January P&L looks. The smart sellers anchor their apparel strategy not around discounts, but around reducing the “confidence gap” for the buyer.

Listing Optimization for Q4

This is the season when Amazon rewrites the rules. Listings with weak review rate get pushed down. Pricing inconsistencies can tank your buy box eligibility. Creative assets once “good enough” suddenly fail to meet event-level benchmarks.

And if your CTR drops below what Amazon considers competitive for the event week, your ASIN can get deprioritized no matter how well you ranked in October.

How Amazon’s New “Trust Signals” Shape Ranking

Amazon’s ranking system has quietly shifted from a keyword-first model to a trust-first model. The platform now evaluates whether a listing is safe to send event traffic to before it considers where to place it. That means your rank is influenced by deeper behavioral and structural signals that determine how “reliable” your product looks in a high-volume environment.

This trust layer is built on four basics:

- Review velocity quality

It’s no longer about how many reviews you have it’s about how steadily you receive them, how recent they are, and how balanced the sentiment looks. A product that gets a consistent, healthy review flow is treated as a stable performer and gets more impressions during peak weeks.

- Branded content alignment

Amazon wants to see coherence between your brand store, A+, and PDP. When your content matches across all touchpoints, Amazon treats your listing as lower risk. Mismatched claims, outdated images, and inconsistent messaging trigger more aggressive automated checks.

- Pricing consistency

If your price on Amazon doesn’t match your external channels or if your historical pricing fluctuates aggressively, Amazon may reduce your visibility. In Q4, when deal traffic is extremely sensitive, Amazon avoids routing shoppers to listings with potential pricing instability.

- Hidden relevance audits

Amazon continuously evaluates whether your listing is truly relevant for the keywords you’re receiving impressions for. If engagement drops or your content doesn’t match shopper intent, your relevance score dips, which affects ranking even if your keywords are accurate.

Why Do Listings Get Deprioritized in Q4 When CTR Drops?

During Q4, Amazon tightens its performance expectations. With millions of shoppers flowing in, Amazon reallocates impressions toward products that deliver above-benchmark CTR and conversion for each specific event (Prime Day-like deals, Cyber 5, Holiday Gifting, and Last-Minute Delivery Week).

If your CTR falls too far below similar listings in your category:

- You won’t get a warning

- You won’t see a suppression notice

- Your ranking simply slips

- Your impressions quietly disappear

This is Amazon’s way of managing traffic to the most efficient listings during high-stakes periods.

Sellers can preemptively protect your listing by improving click-through elements before event traffic peaks. That means refreshing your hero image, fixing title clarity, updating price anchors, and adding seasonally relevant visual cues long before your competitors start reacting.

Once CTR stabilizes or improves, Amazon restores impressions fast.

How to build High-Intent Bundles

Bundles perform exceptionally well in Q4 because they align with how shoppers want to buy during gifting season: fast, convenient, and value-packed.

Amazon sees bundles with strong conversion as high-quality signals and rewards them with more impressions.

High-intent bundles work because they:

- Reduce comparison friction (bundles are harder to price-match)

- Increase perceived value without increasing your cost structure

- Lift average order value, which gives you more margin to reinvest in ads

- Strengthen conversion rate, which improves keyword ranking

A strong Q4 bundle pairs a hero product with low-cost but high-perceived-value items like cleaners, accessories, organizers, add-ons, sample sizes, gift inserts, or anything that enhances the experience.

Event-Specific Keywords

Throughout Q4, search intent changes significantly. Customers do not enter the same things during Cyber Week or the final 10-day shipping window as they do in October. Instead of displaying a static list of keywords, Amazon wishes to provide listings that fit the current intent pattern.

Because of this, vendors that rank highly for event-specific modifiers eventually control organic positioning.

That’s why sellers who rank early for event-specific modifiers end up dominating organic placement later.

These are some examples of event-intent shifts:

- October: “gift ideas,” “hosting,” “decor setup,” “best for home”

- Cyber Week: “deals,” “under $25,” “sale,” “limited time”

- Holiday week: “arrives before Christmas,” “last-minute gifts”

- Late December: “clearance,” “bundle,” “new year essentials”

Amazon recognizes that your product is currently relevant when these modifiers are used in your listing’s titles, bullets, backend keywords, and advertising campaigns. Additionally, relevant items receive more steady ranks and less expensive traffic.

This turns into an advantage for sellers: when CPCs soar, pre-event optimization locks in inexpensive early impressions that develop into organic domination.

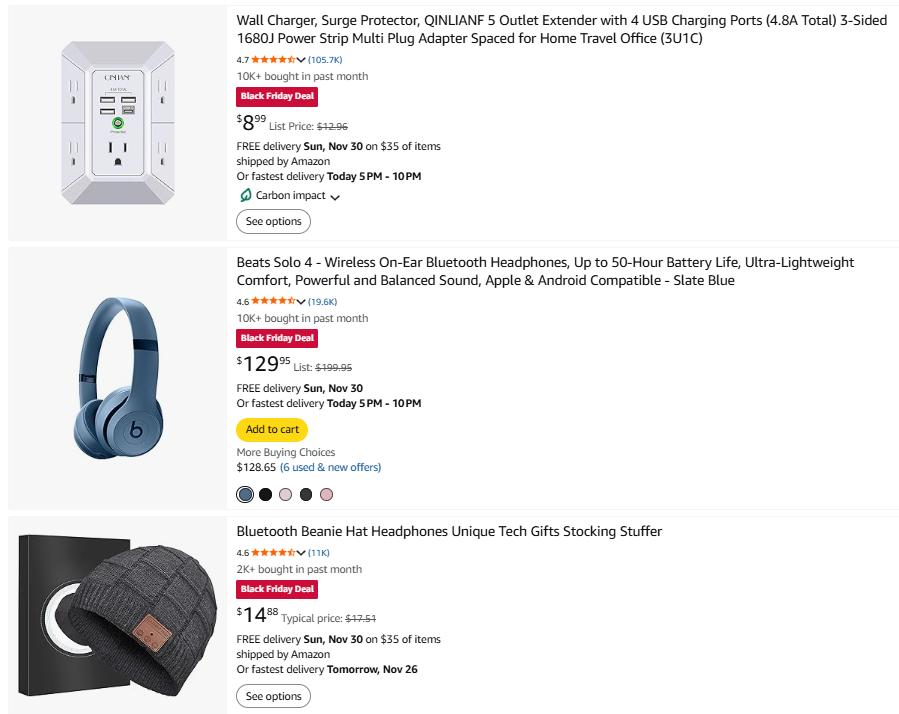

Strategic Pricing & Deal Logic

Pricing in Q4 used to be different, and that era is gone.

Today, deep discounts often do more harm than good, destroying margins, diluting brand value, and triggering buy box instability that can wipe out an entire season’s gains.

Amazon’s deal system has evolved, and so have the algorithms that decide whether your discount even deserves visibility.

1. Why Is “40% Off” No Longer Effective?

There was a time when deep discounts were enough for Q4. But the marketplace has changed, and dropping your price by 40% now doesn’t help much.

With time, shoppers have become deal-aware, not discount-blind. Amazon’s algorithm has become margin-sensitive, not discount-hungry. And brands are realizing that aggressive markdowns create long-term damage that Q4 cannot justify.

The first problem is margin loss. Every year, Q4 CPCs rise faster than conversion rates. When you stack inflated ad costs on top of a steep discount, the “profit” you see during Q4 is often an illusion. By the time returns are processed in January, sellers discover they didn’t make any profit.

The second problem is brand loss. When you anchor your hero product at a 40% cut, the higher price never recovers. Shoppers remember the discount, not the product. Competitors price-match. Amazon’s pricing algorithm rewrites your “true” value. Now your Q4 gain becomes a Q1 liability.

2. How Experienced Sellers Stack Deals Without Destroying Margin

The sellers who prepare for Amazon Q4 consistently make profit by building a pricing structure, a sequence of small but psychologically powerful incentives rather than one heavy-handed discount.

Instead of “40% off for five days,” they use layered, event-timed pricing that produces the same psychological pull but preserves margin:

- A light coupon creates a “momentum signal.”

- A 7-Day Deal introduces a shelf-life urgency.

- A Lightning Deal adds scarcity.

- Event stacking (like combining a coupon and a deal price) amplifies visibility without doubling the financial hit.

The reason this system works is that new kinds of consumer pressure are created at each stage. For the majority of customers to make a purchase, only one of those triggers is required.

You can lessen your reliance on drastic discounts by spreading incentives over a number of events. Additionally, Amazon’s algorithm will perceive your product as an active, engaged, and fast-moving ASIN, improving your placement during peak hours.

Listings with steady, consistent velocity are preferred by Amazon vs. those that surge once and then fall. Pricing ladders provide that.

3. How Amazon Events AI Decides Whether Your Deal Deserves Visibility

Amazon’s Events AI, which deals with visibility and positioning, is stricter than ever. It no longer rewards deals just because they exist.

- If your deal is too shallow for your category’s expected lift, Amazon may reject it entirely.

- If your deal history shows weak engagement, the system deprioritizes it.

- If your discount structure doesn’t match inventory levels, it lowers visibility.

The underlying principle is that Amazon uses its AI to avoid showcasing deals that won’t convert. During Q4, this becomes even harsh because the platform must protect the high-intent shopper experience.

The advantage for sellers who understand this is huge. You can craft deal structures Amazon is willing to promote by aligning:

- discount depth

- category elasticity

- inventory position

- seasonal lift expectation

- price history

4. When should you avoid deals?

There are moments in Q4 where running a deal actively works against you.

A deep discount can push the featured offer rotation into a race to the bottom, especially if you share the listing with resellers or distributors.

Once your Buy Box moves around:

- Your deal loses placement.

- Your ads stop converting.

- Your margin collapses.

- Your ranking slips because Amazon sees unstable pricing.

This can happen even if your offer is technically a “deal.” Amazon doesn’t prioritize deals; it prioritizes price stability and conversion reliability. A discount that triggers buy box instability tells the system your ASIN is risky, not high-value.

The smartest Q4 operators avoid deals when:

- FBA inventory is tight

- The competition includes unauthorized sellers

- Your ad costs exceed contribution margins

- Your recent return rate threatens profitability

- The discount would anchor your price too low for the January recovery

7 PPC Strategies for Q4 2026

These seven strategies are structured for sellers who are ready to prepare for amazon q4:

1. How to Train Amazon’s Relevance Engine Before the Surge

Most sellers wait for Cyber Week to scale PPC. But Amazon’s relevance engine is trained 2–3 weeks before big events. If your ASIN isn’t already scoring high on click-through, conversion, and keyword alignment, your bids become 30–60% more expensive during peak hours.

The smart move is to set up your ASIN with micro-budget “signal campaigns” focused on:

- Ultra-relevant long-tail queries

- Near-match variations (especially plural/singular and gift-intent terms)

- Branded search terms with 30–40% bid concentration

By the time traffic spikes, Amazon has already seen enough stable positive signals to give you a lower cost per click than competitors who rushed in late. Instead of wasting budget fighting inflated CPCs during the event, you “pre-qualify” your ASIN so Amazon rewards you with cheaper placements when it matters most.

2. Why You Shouldn’t Aggressively Bid at 6–10 AM on Event Days

Every event (Prime Day, Turkey 5, and January 1 reset) has the same pattern: early morning CPC inflation with some of the lowest conversion rates of the day.

This is because:

- Deals go live

- Shoppers browse but don’t buy yet

- Competitors overspend trying to “own the day early.”

The result is a 2–3 hour auction where CPC doubles but conversions lag behind.

The strategy is delayed aggression:

- Hold 60–70% of your daily ad budget for the 10:30 AM–7 PM window

- Raise bids progressively as conversion improves

- Push top-of-search once add-to-cart momentum builds

This avoids burning 20–35% of your budget in the “window-shopping phase” and allocates spending when buyers are actually making decisions.

3. The Post-Event Salvage Window (Your Hidden Profit Zone)

Q4’s most profitable hours are often after the event, not during it.

Across categories, 4-6 days post-event:

- CPC drops 18–30%

- Add-to-cart completes catch-up.

- High-intent buyers return for items they browsed but skipped

- Competitors dramatically reduce budgets

During this time, you may get cheaper conversions with the same holiday intent by running branded advertising, sponsored products, and clever retargeting. While competitors go dark, this is how companies recover 20–50% of their event-spend losses.

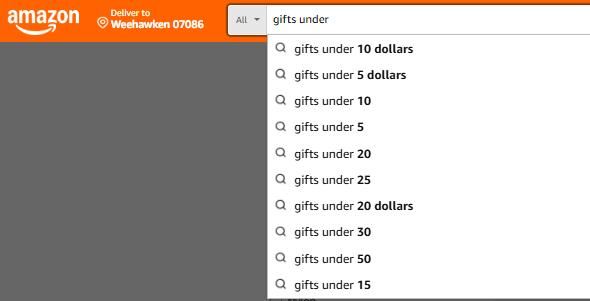

4. Why Broad Match Quietly wins Q4

Shopper behavior becomes erratic and chaotic in Q4.

Individuals conduct emotional, hurried, and non-linear searches. Instead of typing the name of your goods, a customer might type something like

- “gifts under…”

- “something for dad…”

- “party essentials…

- “last-minute gifts…”

- “top rated [category]…”

- “for a 7-year-old…”

Exact match is too rigid for this inconsistency.

It only catches the shoppers who already know exactly what they want, a minority in the gifting season.

Broad match thrives because:

- It captures new phrases you wouldn’t predict

- It adapts to seasonal and event-related search spikes

- It surfaces your products for “solution queries,” not just product queries

- It helps Amazon learn which holiday-intent queries convert for you

- It discovers profitable modifiers that exact-match campaigns miss entirely

Amazon prioritizes intent fulfillment above exact keyword matching during gift-giving season. Your PPC efficiency and organic visibility for the remainder of the season are impacted if a broad match term generates high conversion for your ASIN in Q4.

5. Use Single-ASIN Funnels Instead of Keyword Dumps

Most sellers scale by dumping more keywords into campaigns during Q4. That dilutes relevance and weakens CTR.

The better approach is single-ASIN, single-intent funnels:

- One funnel for gift-intent terms

- One for high-repeat-buying terms

- One for premium/value-based shoppers

- One for seasonal-variant keywords

- One for branded terms

6. Train Amazon’s AI With “Conversion Clusters”

Amazon quietly weighs “clustered purchase behavior” more heavily during Q4. Which means if several cohorts (age groups, zip codes, interest groups) buy your product in a pattern, your ad relevance shoots up.

You can intentionally create purchase clusters by:

- Running targeted DSP audiences (if available)

- Running remarketing to specific subsets

- Pushing offer claims to the same group of shoppers via email/social

This creates predictable purchase patterns Amazon picks up on “high-confidence buyer intent. Once Amazon believes your ASIN is “cluster-convertible,” the platform gives you cheaper impressions and more top-of-search.

7. The “CASA Method” for Q4 PPC Stability

You eliminate 70% of wasted ad spend and stabilize ROAS when competition peaks. This is a simple advanced framework that stops budgets from collapsing during peak hours:

C: Control your branded space

Run aggressive defense campaigns so competitors don’t steal your cheapest conversions.

A: Accelerate only when converting

Raise bids only after ATC (add-to-cart) momentum rises, not during browsing hours.

S: Segment campaigns so Amazon can categorize you correctly

Clustered campaigns = faster learning.

A: Adapt bid ceilings hourly

Use dayparting rules with 3–4 bid tiers across the day.

4 Major Risks Sellers Face During Q4

These are the four risks that catch most sellers off guard, and these are the same risks that the top 1% prepare for months in advance.

1. Inbound Delays

Every Q4 follows the same pattern: Amazon’s receiving speed slows significantly as volume spikes. Quietly, what typically takes three to five days in September grows to ten to twenty-one days in November. The uneven deceleration causes unpredictable gaps in replenishment since some FCs continue to move while others stall.

“Stocking out” is not the only risk. Supply freeze, which is merchandise stalled in FC transit that keeps your ASIN from maintaining sales velocity, is the true threat. When velocity falls just before peak traffic, Amazon stops giving your placement priority in search.

By developing a delayed supply plan with a buffer that accounts for a 2× inbound delay and sending earlier, smaller shipments to several FCs instead of a single, huge load, sellers can address this issue.

2. Reserve & Delayed Disbursement

During Q4, Amazon boosts safety buffers to stop fraud and seller default. This implies that a larger percentage of your money might be kept in reserve or released later than normal. This lag can silently destroy momentum if you rely on weekly payouts to finance advertisements, restock inventory, or promote offers.

The majority of merchants are caught off guard when advertising expenditures are not taken into account. You keep spending money on PPC every day as payout schedules get longer. It is cash flow, not profit, that breaks first in Q4.

Preparing a liquidity buffer or moving a portion of your inventory to a 3PL or FBM backup is the only way to avoid income being entirely dependent on Amazon’s payout schedule.

3. Listing Suppressions Spike Harder in Q4

Due to increased fraud, counterfeits, and policy violations in Q4, Amazon tightens automated filters. ASINs that coasted all year suddenly get flagged for issues like

- Image guideline violations

- Missing variations

- Pricing inconsistencies

- Brand name mismatches

- Safety wording (especially in Beauty, Toys, and Electronics)

These suppressions cut off your conversions when you need them most because they frequently happen without warning and during periods of strong traffic. The only safeguards include conducting a pre-Q4 audit on each ASIN, resolving borderline issues, and creating fast-response SOPs to ensure that suppressions are lifted in a matter of hours rather than days.

4. Customer Messages & Returns Need a Separate Q4 SOP

Q4 shoppers are different. They buy faster, return more, and message sellers more. Response times shrink as demand rises. One unresolved message or delayed reply can hurt your account health score. The bigger problem is that post-purchase anxiety spikes during holiday shopping, and buyers expect faster answers.

Returns also increase across nearly every category due to gifting, size mismatches, impulse purchases, and “bought two, returning one” behavior. If you’re not prepared, these returns hit your IPI score, impact restock limits, and slow down your forecast accuracy.

A dedicated Q4 SOP with faster responses, templated replies, dedicated staff, and automated return processing keeps your metrics clean and prevents the January penalty that many sellers face.

How Your Q4 Momentum Can Impact 2026 Growth

If you are thinking that Q4 Amazon disappears when December ends. Well, interestingly, the energy you build in those eight intense weeks follows your brand well into 2026. The majority of sellers concentrate on the revenue surge, but those who consistently succeed pay attention to what the spike generates, such as larger audiences, more distinct purchasing patterns, and a brutally honest picture of which products should be available the next year.

The first place this shows up is in retargeting. Q4 Amazon shoppers behave with unusual intensity; they compare, revisit, hesitate, and come back again. Even the ones who didn’t buy left behind a signal, and those signals become the warmest audience you will have all year.

When January and February traffic turns cold and cautious, the brands that glide through the slowdown aren’t hunting for new customers. People who previously engaged with their listings during the year’s highest-intent season are being reactivated. For this reason, Q4 momentum frequently lowers Q1 acquisition costs without affecting ad expenditures.

The genuine profitability check is the next step that most vendors dread. Q4 dashboards always look beautiful until January returns start landing. Suddenly, the truth becomes impossible to ignore. Some ASINs that looked like heroes collapse under refund rates.

Others that you barely noticed turn out to have the most stable, margin-friendly customer base. An honest ASIN-level review after returns settle is one of the most valuable exercises you can do. It shapes which products should be your 2026 focus, which ones need pricing adjustments, and which ones you should quietly retire before they drain resources all year.

But the greatest gift Q4 Amazon gives you is insight into human behavior. Buyers shop differently in November and December. They pick variations you never expected to sell. They discover surprising product pairings. They react strongly to tiny changes in images or copy. If you pay attention, Q4 Amazon becomes the best product research lab you’ll ever get.

Many of next year’s most successful bundles, variations, and keywords are hiding in Q4 data revealed not by volume, but by intention. The combinations people buy as gifts often make perfect evergreen bundles. A sudden surge in a color or size can tell you what your next variation should be. And the long-tail, emotional holiday keywords often reveal the hidden intent phrases that convert year-round.

January then becomes the reset month. It’s chaotic for everyone as the traffic dips, returns pile up, and ad performance feels unpredictable. But this is also the month that determines how clean and profitable the rest of your year will be. Brands that keep scaling treat January like maintenance season.

Slow variants are eliminated, prices are restored following Q4 discounts, bloated ad campaigns that became chaotic during the rush are streamlined, suppressed listings are resolved, variations are reorganized, and inventory is rebalanced to prevent storage fees from reducing Q1 earnings. This is the month to regain control.

Case study

During Amazon Q4, a mid-enterprise home and kitchen brand with tight margins faced rising CPCs amid heavy competition. Rather than pulling back on spending, they benefited from SellerApp’s robust PPC analytics and bid optimization, allowing them to double down on visibility. This strategic use of SellerApp’s platform resulted in a 25% increase in ad impressions and a 15% lift in product clicks for their electric kettle, making it a top contender during the peak shopping season.

Buyers demonstrated high engagement metrics, with add-to-cart rates exceeding 12%, but a significant portion abandoned their carts while comparing gift options. SellerApp’s audience insights tracked these high-intent interaction signals, allowing the brand to build a segmented retargeting audience. When category demand dropped sharply in January, continued retargeting via SellerApp lowered acquisition costs by 30% year-over-year, stabilizing sales without chasing new shoppers.

Additionally, SellerApp’s keyword research analytics revealed rising trends around “matte finishes,” “minimalist designs,” and “bundle options” during Q4. These insights directly informed the brand’s 2026 product strategy, leading to the launch of a matte black kettle variant and a curated gift bundle. These new launches outperformed the original product with a 20% higher conversion rate, proving the value of SellerApp’s data-driven product and marketing strategy during Q4.

Final Thoughts

Every click, cart addition, and hesitation before checkout that a customer makes during Q4 on Amazon leaves a trail. If you look closely, you can see how consumers compare items, what they want, and why they select one brand over another. Due to their excessive attention to the scoreboard, most merchants fail to see this.

However, Q4 Amazon is not viewed as a single sprint by sellers who constantly expand. They utilize it as a springboard. They use the surge of seasonal traffic to create long-lasting trends, gather insights that inform their product plan for the next year, and warm up audiences they can retarget.

The chaos becomes useful when you enter with clear, organized data, a follow-up plan, and strict procedures. Your advertisements begin to learn more quickly. Your listings maintain their ranking for a longer period. Your inventory decisions become more deliberate and composed. Additionally, you shield the margin rather than allowing it to bleed.

We understand how hectic it must be for sellers. And that is why SellerApp has been helping sellers for more than a decade with pricing intelligence, keyword optimization, and customer behavior. You get a team of experts to execute this all. SellerApp’s managed services is a system built to handle your Q4 Amazon efficiently. Because, in the end, Q4 Amazon is about more than just the revenue bump that everyone is talking about.

It’s the time of year when you can clearly see what needs to be increased, what needs to be reduced, and how to direct growth over the next 12 months.