How Amazon Tax Exemption Program (ATEP) Works

Amazon Business has several features and tools to ace your online business and create the best customer experiences. Besides, it has a procurement program that offers tax exemption to organizations.

To make it less overwhelming, we’ve put together all things you need to know about Amazon’s Tax Exemption Program (ATEP). Along with that, we give you the most commonly asked questions from some of our business customers.

Quick Guide

- Introduction

- Should you consider Amazon Business?

- Everything you need to know about Amazon’s Tax Exemption Program

- What are the uses of enrolling in ATEP?

- How ATEP works during the refund process

- What information does Amazon collect from buyers during ATEP enrollment?

- Final thoughts

Introduction

What is ATEP

Amazon Tax Exemption Program (ATEP) is a program, which allows an organization to use their tax exemption status towards purchases that take place on Amazon Business.

If you’re new to Amazon Business, it is a platform that makes it easy for sellers and manufacturers to sell products directly to registered businesses. The benefits are plentiful, so there’s absolutely no reason not to sign up for an Amazon Business account.

Should you Consider Amazon Business?

With Amazon Business, you get advanced tools and features like Business pricing, tax exemption, enhanced seller logo, and more. Currently, this option is available in marketplaces, including the US, France, Japan, Canada, UK, Italy, Spain, Germany, and India.

Check out this guide to know how to use amazon for your business.

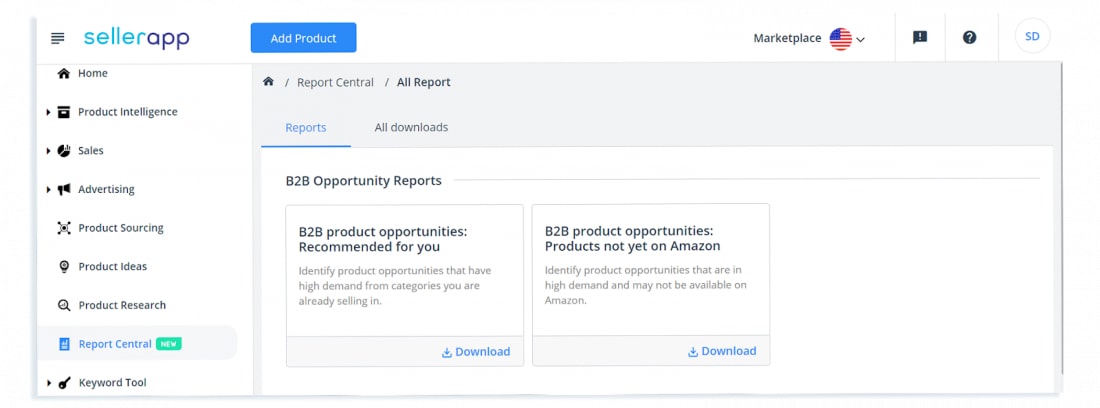

If you are a professional seller on Amazon, you have access to all the tools and features that can help you scale your business and distinguish your company from the competition. If you want to know whether selling on Amazon Business is the right fit for you, make sure you check out SellerApp’s Business reports. With our Business reports, you can get insights into customer interests and find what products are profitable in your category. You can also log in to SellerApp’s platform to get these reports.

Log in to SellerApp > Go to Report Central > Download B2B Reports

Recommended: A Brief Guide to Amazon Business Reports in 2021

Everything you need to know about Amazon’s Tax Exemption Program

Coming back to Amazon’s Tax Exemption Program, buyers and organizations who shop using Amazon’s platform qualify for sales tax exemptions. Amazon sellers who are enrolled in this program need to accept exemptions from buyers in ATEP. This program will ensure that all orders placed by faculty and staff are tax-exempt.

As a participating seller, you will find automatic handling of buyer exemptions through your Seller Central account. Buyers who don’t come under tax exemptions at the time of purchase may request tax refunds later from you. If you want to learn more about post-tax exemptions, check out this link.

In general, the tax exemption applies to items sold by:

- Amazon.com LLC

- Amazon Digital Services, Inc.

- Warehouse Deals, Inc.

- Amazon Services LLC.

- 3rd party Amazon sellers (vendors) participating in ATEP

Related Post: Amazon Warehouse Deals: A Complete Guide

What are the uses of enrolling in ATEP?

If you are selling on Amazon Business, you may be able to qualify for Amazon Tax Exemption Program. Amazon sellers who participate in the ATEP will see automatic handling of tax exemptions. This automatic handling includes a collection of buyer exemption documents, storage of documents in Amazon’s system, which is accessed through an Amazon seller account. You can find the documents in the Tax Document Library whenever you need them.

Besides, buyers have the ability to filter their search results with sellers who accept or don’t accept the tax exemption.

How to Identify the Orders with Tax Exemption

To identify such orders, you need to use the reporting section available in your Tax Document Library. You will find data in the Buyer Exemption column and exemption documents in your Sales Tax Report under the Tax-Exemption Certificates tab within 72 hours after the order took place.

Is ATEP participation mandatory?

Amazon Tax Exemption Program is an optional service offered by Amazon Business. If you participate, it could help you in reducing buyer questions on tax settings and post-order tax refunds on the orders.

Also, sellers are expected to communicate all the tax setting-related answers when the buyer requests.

How ATEP Works During the Refund Process

In the case of FBA, when a customer requests, Amazon issues a refund of taxes on FBA orders. The tax will be refunded only if Amazon receives supporting exemption documentation, which you can find in your Tax Document Library.

For merchant fulfilled orders, you can offer tax refunds based on the order at any time. In the case of FBA, you can redirect the customers to Amazon customer service. You can also choose to issue a concession refund on the order.

What Information Does Amazon Collect from Buyers During ATEP Enrollment?

This information includes the name of the purchasing organization, type of organization (whether it is a reseller, government, or a charitable organization, etc.), and jurisdictions (state or/and local) for which the tax exemption applies, and other related information.

Along with the information, Amazon also validates the buyer’s information after being enrolled. Besides, it expects the buyers to provide accurate details and maintain valid tax exemption information.

If you want to know more about the Amazon Tax Exemption Program, check out this link here.

Final thoughts

Amazon Business offers many benefits for sellers and buyers. We hope you find this information valuable. If you have any questions regarding Amazon Business, drop us an email at support@staging.sellerapp.com. We’re happy to help!

Read More: How to smartly negotiate the Amazon Vendor Agreement

Related Posts:

Merch by Amazon: How to Get Started

Seedan

November 26, 2021A good resource for amazon sellers regarding Amazon ATEP( Amazon Tax Exemption Program).

Ritagril

November 26, 2021Should I provide an exemption document in case of a refund in fba?

Ashley

March 31, 2022Informative blog.

Arishekar N

May 27, 2022Thanks for reading.

Ashfaq

May 10, 2022Very detailed article on Amazon Tax Exemption Program (ATEP).

Arishekar N

May 27, 2022Glad you liked the article.